Planning for a Distributed Disruption: Innovative Practices for Incorporating Distributed Solar into Utility Planning

Andrew Mills, Galen Barbose, et al, August 2016 (National Renewable Energy Laboratory and Lawrence Berkeley National Laboratory)

Abstract

The rapid growth of distributed solar photovoltaics (DPV) has critical implications for U.S. utility planning processes. This report informs utility planning through a comparative analysis of roughly 30 recent utility integrated resource plans or other generation planning studies, transmission planning studies, and distribution system plans.

It reveals a spectrum of approaches to incorporating DPV across nine key planning areas, and it identifies areas where even the best current practices might be enhanced.

1) Forecasting DPV deployment: Because it explicitly captures several predictive factors, customer-adoption modeling is the most comprehensive forecasting approach. It could be combined with other forecasting methods to generate a range of potential futures.

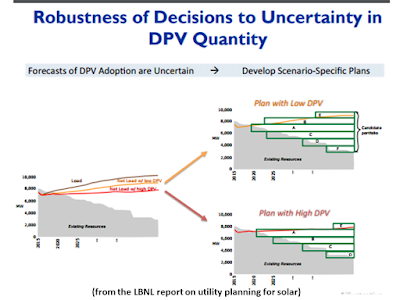

2) Ensuring robustness of decisions to uncertain DPV quantities: using a capacity-expansion model to develop least-cost plans for various scenarios accounts for changes in net load and the generation portfolio; an innovative variation of this approach combines multiple per-scenario plans with trigger events, which indicate when conditions have changed sufficiently from the expected to trigger modifications in resource-acquisition strategy.

3) Characterizing DPV as a resource option: Today’s most comprehensive plans account for all of DPV’s monetary costs and benefits. An enhanced approach would address non-monetary and societal impacts as well.

4) Incorporating the non-dispatchability of DPV into planning: Rather than having a distinct innovative practice, innovation in this area is represented by evolving methods for capturing this important aspect of DPV.

5) Accounting for DPV’s location-specific factors: The innovative propensity-to-adopt method employs several factors to predict future DPV locations. Another emerging utility innovation is locating DPV strategically to enhance its benefits.

6) Estimating DPV’s impact on transmission and distribution investments: Innovative practices are being implemented to evaluate system needs, hosting capacities, and system investments needed to accommodate DPV deployment.

7) Estimating avoided losses associated with DPV: A time-differentiated marginal loss rate provides the most comprehensive estimate of avoided losses due to DPV, but no studies appear to use it.

8) Considering changes in DPV’s value with higher solar penetration: Innovative methods for addressing the value changes at high solar penetrations are lacking among the studies we evaluate.

9) Integrating DPV in planning across generation, transmission, and distribution: A few states and regions have started to develop more comprehensive processes that link planning forums, but there are still many issues to address.

Executive Summary

Analysts project that distributed solar photovoltaics (DPV) will continue growing rapidly across the United States.1 This growth has critical implications for utility planning processes, potentially affecting the size and type of future infrastructure needs as well as the solution set for meeting those needs. Developing appropriate techniques for incorporating DPV’s unique characteristics into utility planning processes—across generation, transmission, and distribution—is therefore essential to ensuring reliable operation of the electric system at least cost. It is also paramount to ensuring that the costs and benefits of DPV resources are fully and accurately valued, because that value may derive in large part from investments that utilities make or avoid owing to needs identified within their planning studies.

With this report, we seek to inform utility planning through a comparative analysis of roughly 30 recent utility integrated resource plans or other generation planning studies, transmission planning studies, and distribution system plans. The rapid growth of DPV has not been distributed equally across U.S. utility territories, and the same is true for projected future growth. While some of the studies we review forecast 2020 DPV penetrations equivalent to 5% or more of retail sales, fewer than half consider penetrations beyond 1% by 2020. Thus it is unsurprising that utilities and other planning organizations have differed in their perceptions about the need to incorporate DPV into resource and transmission and distribution (T&D) plans. Because of this staggered progress, organizations that are just beginning to address DPV can draw on innovative practices from organizations that already are incorporating DPV rigorously into their plans. Our report reveals this spectrum of approaches across nine key planning areas, and it identifies areas where even the best current practices might be enhanced.

Below we summarize current practices and highlight approaches that are innovative and potentially worthy of emulation. We conclude with a brief discussion of future work.

Developing a Forecast of DPV Deployment

The main forecasting approaches across the studies we analyze include stipulated forecast, historical trend, program-based approach, and customer-adoption modeling. About 70% of relevant studies employ one or more of the first three approaches, which rely on few or no quantifiable predictive factors. In contrast, customer-adoption modeling explicitly uses historical DPV deployment, location-specific DPV technical potential, various DPV economic considerations, and end-user behaviors as predictive factors (Figure ES-1). A quarter of the studies use this innovative method, including those by the Northwest Power and Conservation Council, PacifiCorp, Pacific Gas & Electric (PG&E), Puget Sound Energy (PSE), and the Western Electricity Coordinating Council. Though our analysis suggests various ways to improve current customer-adoption models, these models represent the most comprehensive forecasting approach available today.

The quantities and ranges of DPV deployment forecasted in the studies we analyze vary by region, utility, and forecasting method (Figure ES-2). A number of utilities use only a single DPV forecast or consider only a small range. Stipulated forecasts generally have the largest ranges, whereas program-based forecasts tend to have small ranges, and the high end of thirdparty forecasts is above the high end of utility planning forecasts about two thirds of the time. Our analysis suggests that combining various DPV forecasting methods could be valuable. Such an approach might use program goals discounted for uncertainty as lower bounds, customeradoption models to forecast expected levels, and third-party forecasts and stipulated what-if scenarios to explore the full range of plausible futures.

Ensuring Robustness of Decisions to Uncertainty in DPV Quantity

Robustness of decisions to uncertainty in DPV adoption is most clearly addressed in utility integrated resource planning, with some consideration in transmission planning and little in distribution planning. The relevant studies we review use one of three methods to address uncertainty: single forecast (33% of studies), subject to sensitivity (11%), and per-scenario plan (56%). The per-scenario plan method often uses a capacity-expansion model (CEM) to develop least-cost plans for various scenarios, including different levels of DPV adoption (Figure ES-3). Because it accounts for changes in both net load and the generation portfolio, this is the most comprehensive of the three methods. An innovative variation of this approach—acquisition path analysis—combines multiple per-scenario plans with trigger events, which indicate when conditions have changed sufficiently from the expected to trigger modifications in resourceacquisition strategy. PacifiCorp and Hawaiian Electric Companies (HECO) use variations of this approach in their resource planning.

Characterizing DPV as a Resource Option

Fewer than half of the studies we review evaluate DPV as a resource that could be proactively deployed to meet future needs. Those that do consider DPV as a resource use various approaches to determine if it should be part of the plan. The two most common are to compare the performance of candidate portfolios with varying quantities of DPV and to develop minimumcost portfolios via CEMs with DPV as a resource option. Regardless of the characterization method used, the ways DPV is distinguished from other resource options are important. Some utilities dismiss DPV based only on its higher cost and lower capacity factor relative to utilityscale PV (UPV). However, DPV’s capacity credit as well as the avoided losses, transmission deferrals, and distribution-system cost impact associated with DPV also can be significant (Table ES-1). PG&E’s plan stands alone among the utility resource plans we review in accounting for all these factors, which are also important for the locational net benefits methodology in the California Distribution Resources Plans and the New York Reforming the Energy Vision (NY REV) process.

Incorporating the Non-Dispatchability of DPV into Planning Methods

Rather than a distinct innovative practice for incorporating the non-dispatchability of DPV in planning, innovation in this area is represented by evolving methods for capturing this important aspect of DPV. Hourly DPV generation profiles allow for some potential integration issues to be included when evaluating portfolios with DPV, including multi-hour ramping impacts and overgeneration. Most planning studies in our sample appear to use an hourly DPV profile. Impacts of DPV that are not captured with hourly generation profiles, such as sub-hourly variability and uncertainty, can be addressed through detailed integration studies. Various studies quantify the operational integration costs of solar, suggesting a range of $0.5–$10/MWh (for all solar, not just DPV). The methods used to estimate DPV’s capacity credit vary and are not always described. A few utilities use detailed reliability-based models to estimate DPV’s effective load-carrying capability, whereas others use less-rigorous methods to estimate capacity credit. Among the other integration-related issues discussed in the studies, the Los Angeles Department of Water and Power (LADWP) highlights the overgeneration potential of low-load spring days and considers mitigation via electric vehicle (EV) charging during these periods. Combining hourly DPV profiles with detailed production cost models can help in evaluating the role of EVs and other technologies and in identifying times when overgeneration may be a concern.

Accounting for Location-Specific Factors of DPV

Transmission and distribution planning studies require projections of DPV locations. We identify three methods for estimating future locations: proportional to load (40% of relevant studies), proportional to existing DPV (40%), and propensity to adopt (30%). 2 The first two methods proportionally allocate DPV deployment based on the locations of existing load, population, or DPV. The propensity-to-adopt method employs additional predictive factors as well, such as demographics and customer load. Utilities that use this innovative analysis include PG&E, Southern California Edison, and Sacramento Municipal Utility District. Another emerging utility innovation is locating DPV strategically to enhance its benefits. Organizations exploring this tactic include Duke Energy Indiana, Dominion, PG&E, Georgia Power Company, and ISO New England—generally focusing on utility-owned systems. A recent pilot project in Rhode Island demonstrates how promotion of strategic locations for behind-the-meter DPV can help defer feeder upgrades.

Estimating the Impact of DPV on T&D Investments

Innovations in estimating the impact of DPV on T&D investments apply differently to different organizations, depending on each organization’s current progress in this area as well as its projected DPV deployment and the robustness of its T&D infrastructure. For organizations that have not yet considered DPV in T&D studies, innovative examples of such planning are available from numerous planning entities. Likewise, organizations that find themselves needing to calculate hosting capacity—the amount of DPV that can be interconnected to the distribution system without violating operating limits—can draw on innovative studies from their peers. These include the use of hosting capacity analysis to both screen and steer the location of DPV. At the most advanced end of the spectrum, some organizations are already proactively planning investments to accommodate additional DPV. Innovative analyses by Pepco, Dominion/Navigant, and HECO calculate the cost of various options for increasing hosting capacity, including the impacts of advanced inverters and energy storage.

Estimating the Avoided Losses Associated with DPV

Of the studies we review that mention avoided losses due to DPV and provide sufficient detail, we observe three methods to account for these losses: average loss rate (60% of studies), timedifferentiated average loss rate (30%), and detailed analysis of losses (10%). Because of the nonlinear variation of line losses with load, the most comprehensive estimation of system losses— and thus the potential avoided losses with DPV—is a time-differentiated marginal loss rate. However, none of the studies we evaluate appear to use a marginal loss calculation. This represents an area for future innovation. The one detailed circuit-level analysis of losses, by PSE, offers a different refinement at a relatively small scale.

Considering Changes in Costs and Benefits of DPV with Higher Solar Penetration

Perhaps because few utilities expect high penetrations of solar in the near future, innovative methods for addressing the value changes at such penetrations are lacking among the studies we evaluate. Georgia Power Company’s avoided cost of DPV calculations estimate the incremental avoided cost for tranches of DPV, though some details are redacted. Many utilities employ production cost models, and these tools can be used to show changes with increasing solar penetration. CEMs could also account for changes in the costs and benefits of DPV with higher penetration, though some models may need to be modified to account for changes in the capacity credit with higher penetration. In addition, none of the studies mention changes in avoided losses with higher solar penetration.

One complicating factor is that the change in value with penetration may depend on other external factors. LADWP, for example, highlights that EV charging during the day may mitigate some of the challenges with overgeneration. Customer adoption of EVs and their preferences for charging the EVs may therefore affect the value of DPV at high penetration. Given uncertainty in how customer preferences and other factors may change over time, scenario analysis and analysis of the robustness of decisions may be helpful to decision makers.

Integrating DPV in Planning across Generation, Transmission, and Distribution

Fully integrating DPV into planning requires a more comprehensive approach in which distribution, transmission, and resource planning are more tightly linked. A few states and regions—including California, New York, and New England—have started to develop these more comprehensive processes, but there are still many issues to address. Understanding the range of different approaches across the United States and highlighting innovative practices should help accelerate those changes.

Future Research

With future research, we will analyze whether some of the innovative practices identified here can meaningfully affect planning study results. Of particular interest are innovative practices for forecasting DPV adoption, examining the robustness of decisions to DPV uncertainty, and considering DPV as a resource.

click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge

click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge click to enlarge

click to enlarge

Plug-in Hybrids, The Cars That Will Recharge America

Plug-in Hybrids, The Cars That Will Recharge America Oil On The Brain

Oil On The Brain